Coming Soon

We are in the process of updating our website. Thanks for your understanding.

How to complete your work activities report online

Highlights:

Scope of SSA-821: This form reports jobs and income post-disability onset.

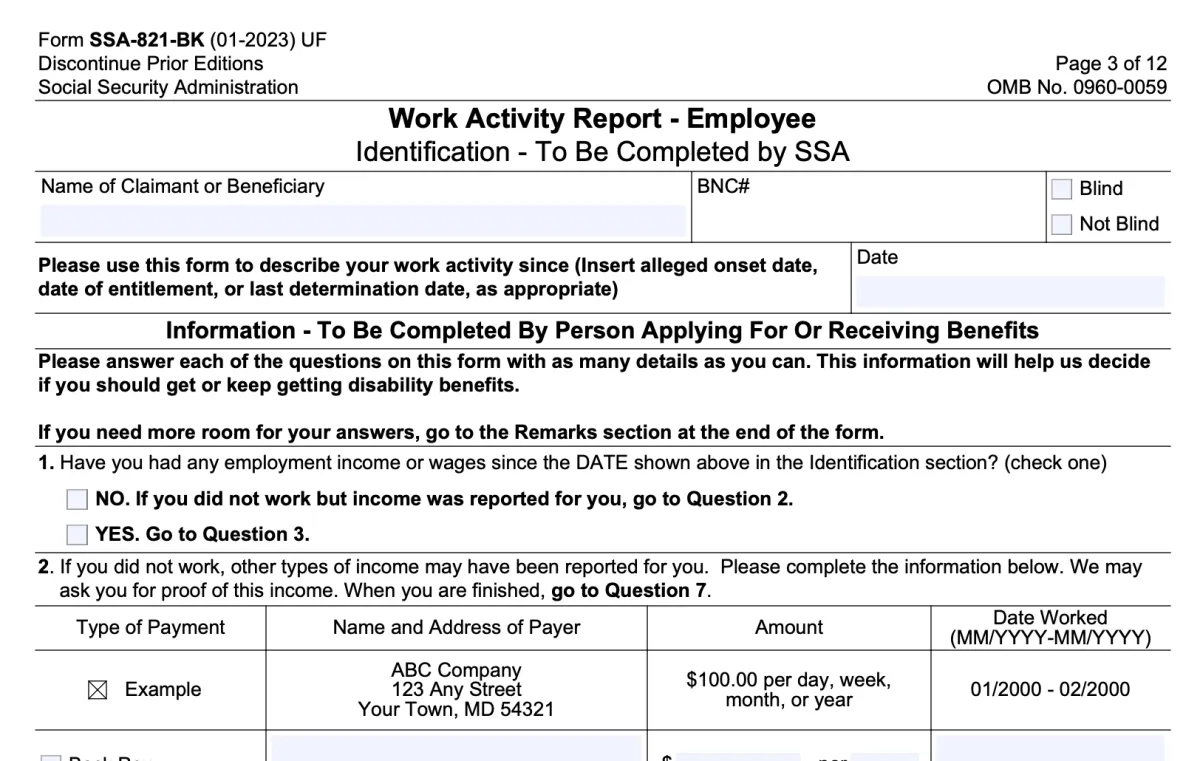

Cover Page: The SSA-821 cover lists known post-onset employers and earnings. Applicants need to fill in gaps with details of unlisted work.

Question 1: Check if employment income was received post-onset. If 'yes,' jump ahead to Question 3; if 'no,' proceed to Question 2.

Question 2: Applicable if Question 1 is 'no' – disclose non-work income (like Workers' Compensation), then hop to Question 7.

Question 3: Detail work activity and earnings if post-onset employment exists.

Question 4: Note any extra employer payments beyond regular pay, like sick or vacation pay.

Subsidies and Accommodations: Halfway through, the form pivots to the importance of subsidies, IRWEs, and UWEs in work capacity evaluation.

Question 5: Subsidies – Document employer assistance or accommodations due to health conditions.

Question 6: Unsuccessful work attempts – List work under six months that ceased due to health or removal of special accommodations.

SGA & UWEs: Note that DDS may not count substantial but brief work periods when assessing disability.

Question 7: IRWEs – List expenses incurred due to health conditions necessary for work.

Receipts and Deductions: Save those receipts – they can impact income assessment while not reimbursed.

Remarks: A space for anything not covered – any other work-related info goes here.

Doing the right thing, like reporting your earnings to Social Security, can trigger a landslide of bulky envelopes with scary deadlines and highlighted portions. Having the right team on your side is essential to tell you simple things like don't panic. Did you know you can complete your work activities report online?

Let's break down this work activities report in the online SSA-821 form. Sometimes, it doesn't open with Chrome. If you experience this, have another browser ready. The cover page kicks off the show by listing what the SSA thinks they know about your work and economic situation Since the last time they checked in-you've gotta fill in the blanks.

The awesome part is that you can attach pay stubs and other documentation to the form. Previously, you had to cram all this paperwork in the same postage-paid envelope they sent. You might have better luck solving a Rubik's Cube. Online is a good option if mobility is challenging because you don't have to find a post office or your neighborhood FedEx/ UPS Store.

If your wallet's been thin and nothing's coming in, you'll put that on any other income you've received, like holiday pay or Workers' Compensation in Question 2.

Question 3 is your tell-all diary entry if you've had some work action. Don't forget to include any extra perks you got from the job, which Question 4 digs into.

The form then gets nosy about help you've gotten at work due to your health (Question 5's about that), any short-lived job stints that tanked because of your condition (hello, Question 6), and the real kicker—expenses you've had to swallow to keep going at work (that's where Question 7 comes in). Keep those receipts; they're like gold for reducing the income SSA counts.

Lastly, there's this sweet spot for remarks, just in case there's more to your work story that hasn't been covered. So, there you have it: your trusty guide to the SSA-821. Keep it real, keep it detailed, and keep those receipts.

You will get proof of submission emailed to you after completing the form. We recommend downloading a copy for your records. The A-Team is here to guide you through the process. We do our best to cut through the Layers of intimidating paperwork and fear. We are working with you to develop solutions and give you peace of mind.